Section 3

Contextual Confidence

How circumstances dictate confidence levels

The economic and political environment weighs on retirement savers

Many are electing retirement options backed by bonds, with no inflation protection

But how do they secure a diversified balance of guarantees, inflation protection and growth?

View the detailed responses below.

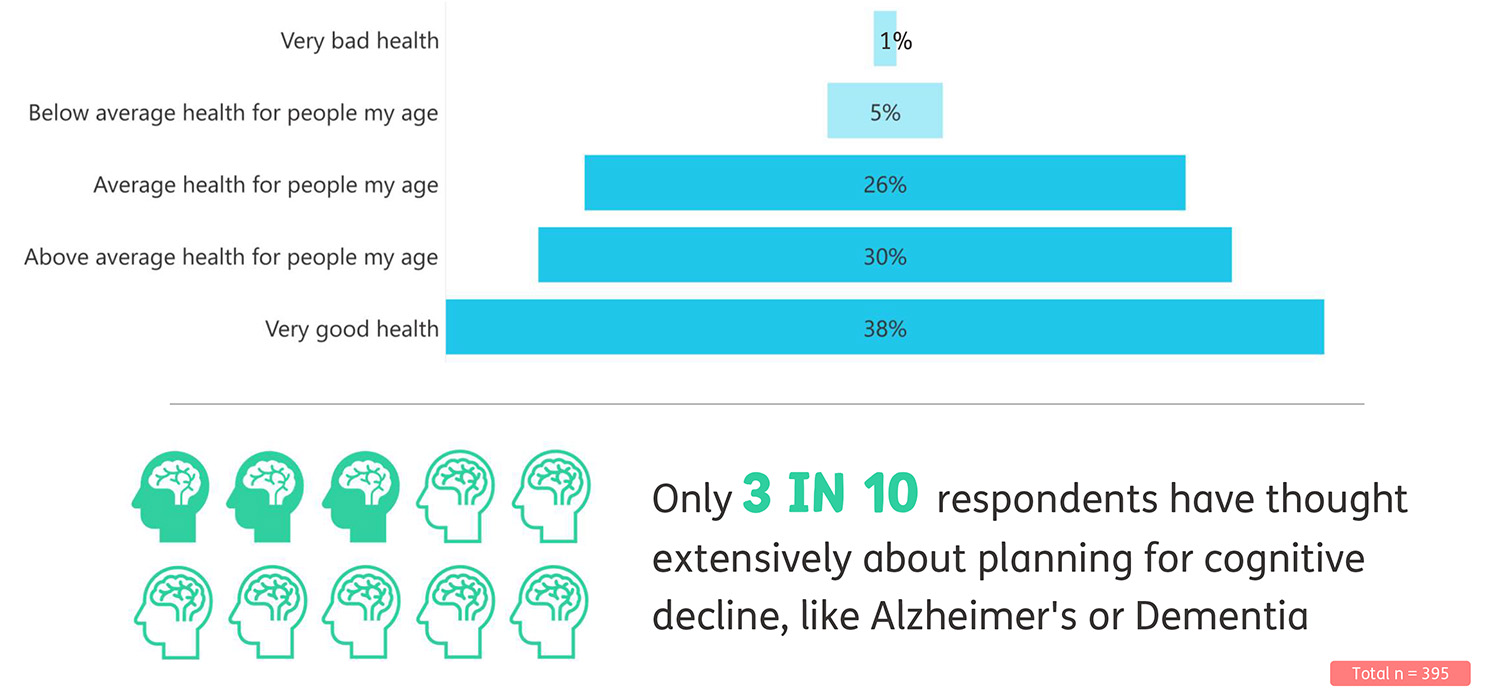

Optimistic expectations about health

Respondents tend to project their current sense of good health into the future, particularly mental health, and only three in ten respondents have thought extensively about planning for cognitive decline due to Alzheimer’s or Dementia.

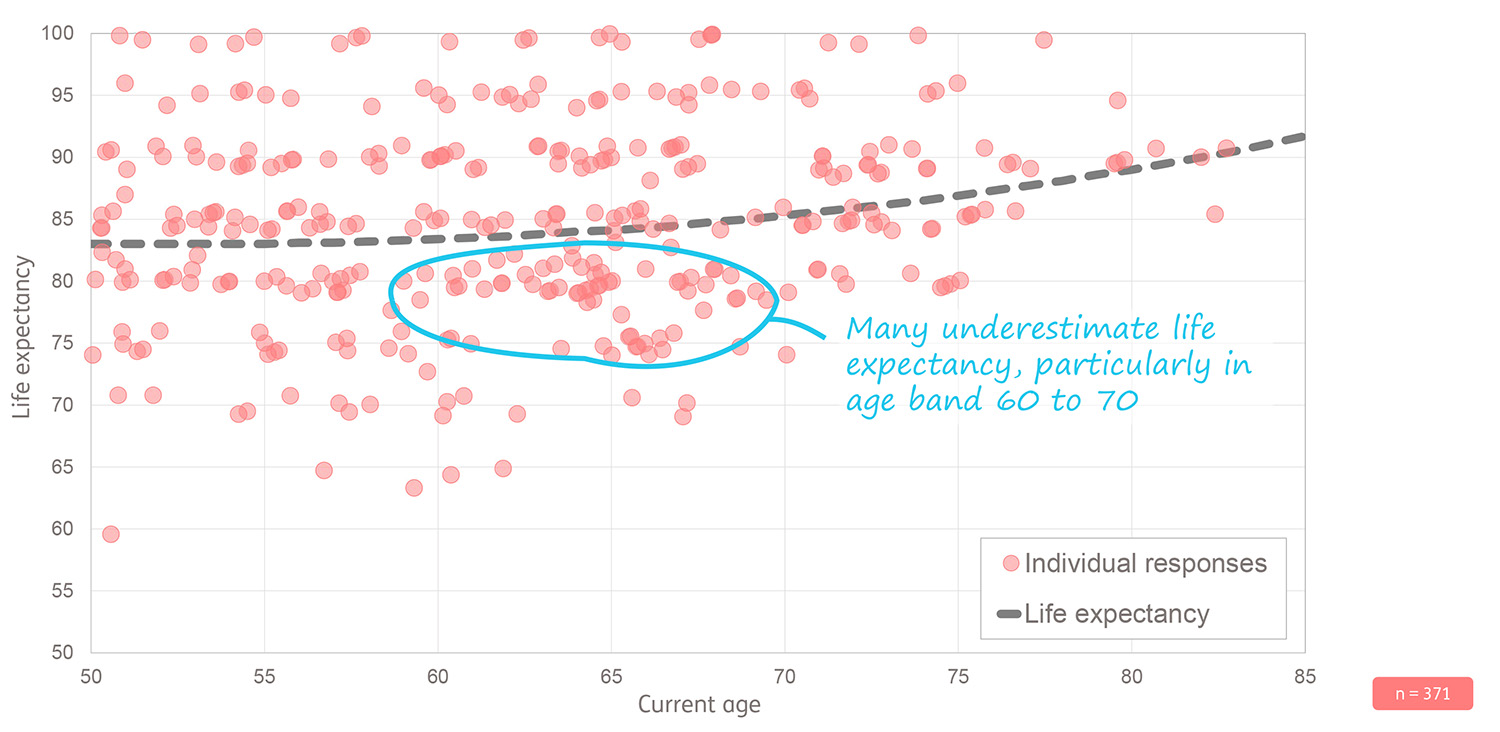

Estimating own life expectancy

There was a wide distribution of estimates when predicting longevity. On average respondents think that they will live to approximately age 85, which is in line with current longevity statistics. However, looking at the longevity estimates of different age bands in the study, it is evident that individuals don’t accurately estimate their own life expectancies.

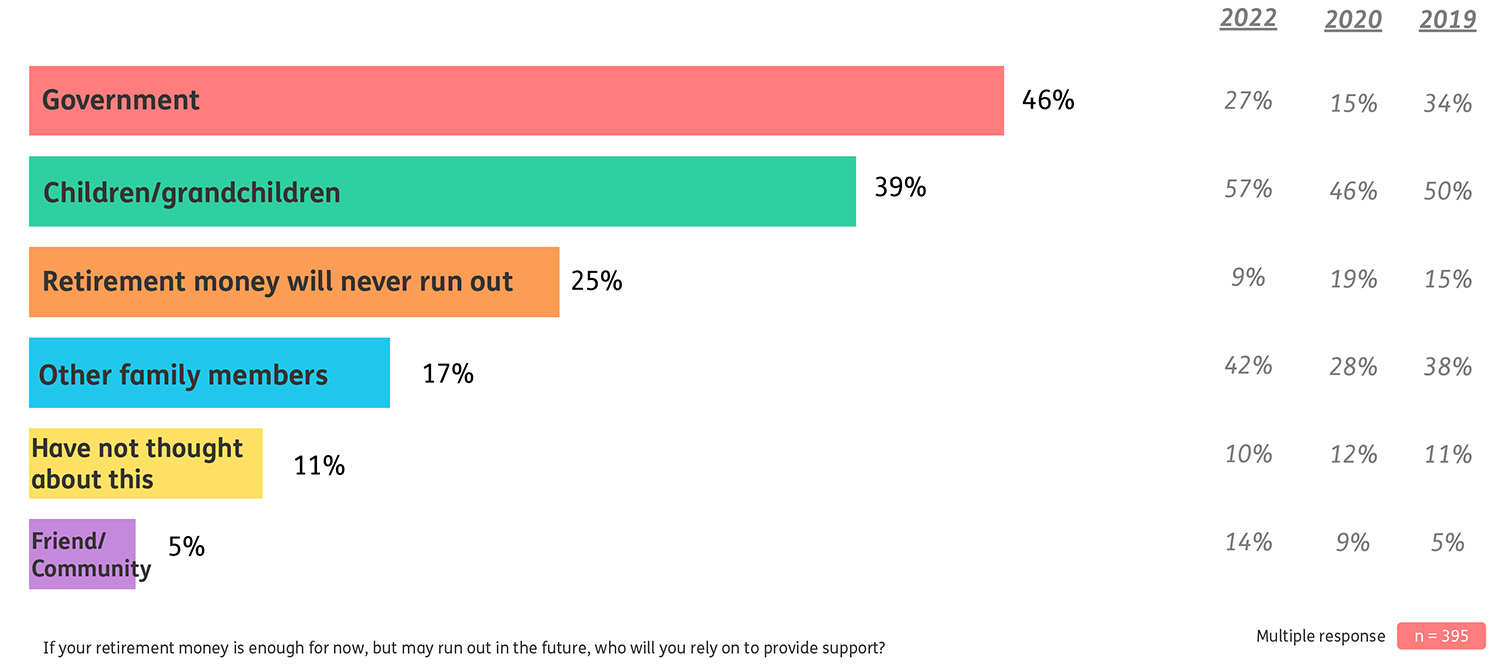

Increase in stating reliance on government for support

Approximately three-quarters of the population reach retirement age without a funded pension benefit, and hence rely on a government social assistance.

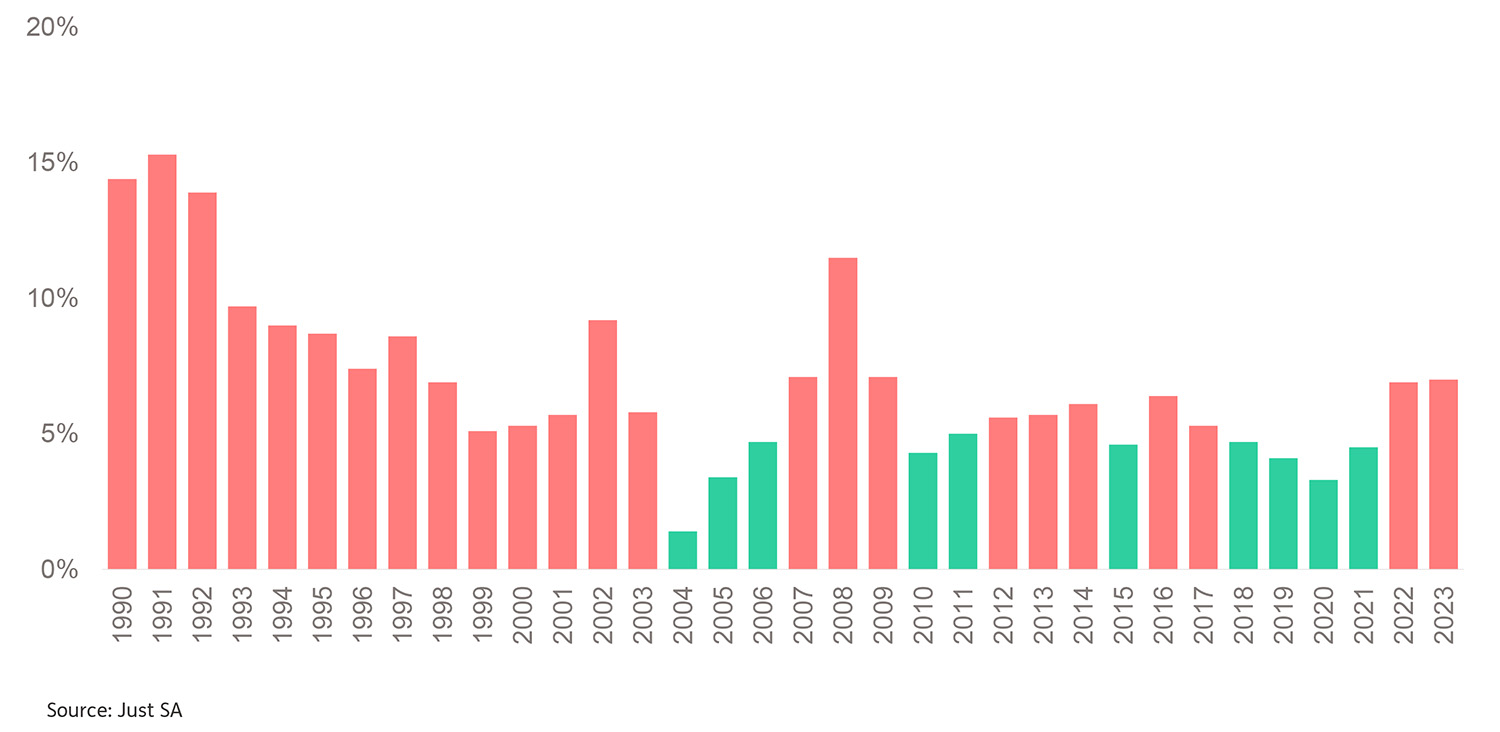

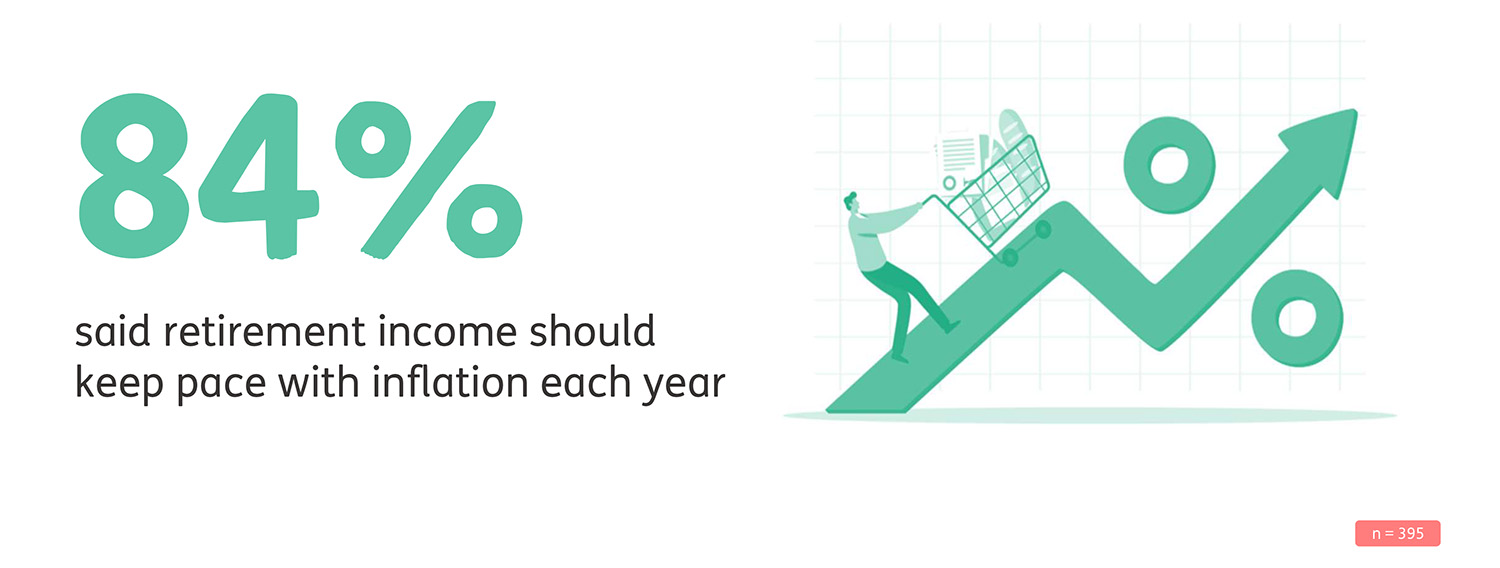

Retirees under strain from inflation

Inflation is enemy of your savings because you always need to take it away from any growth to find out the real rate of return.

How important is it for your retirement income to keep up with inflation each year? (Those who said very important and extremely important)

Because inflation impacts retirement

History shows that SA inflation has been below 5% for only 10 calendar years over the last 33 years.