Section 2

Financial certainty

People seek certainty, and not only in times of uncertainty. Intend to use funds to generate a reliable income for life – but still uncertain if it will be enough. Most are not confident they have saved enough and expect to turn to children when they run out.

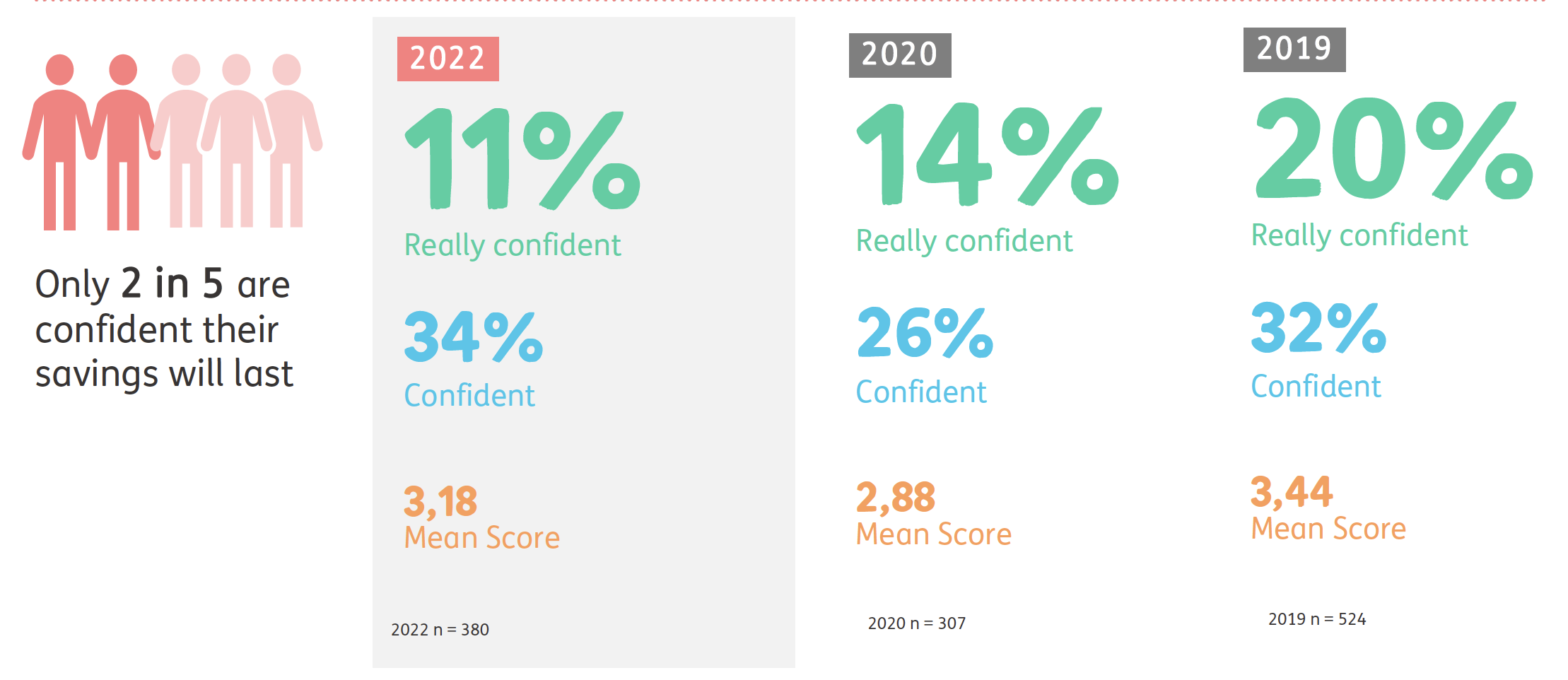

More than half not confident they have saved enough for retirement

Please rate your level of confidence that your income (money) will cover your monthly expenses in retirement if you reach the age of 100, allowing for inflation. Mean Score: Really confident = 5, Confident = 4, Not sure = 3, Not confident = 2 & Really not confident = 1

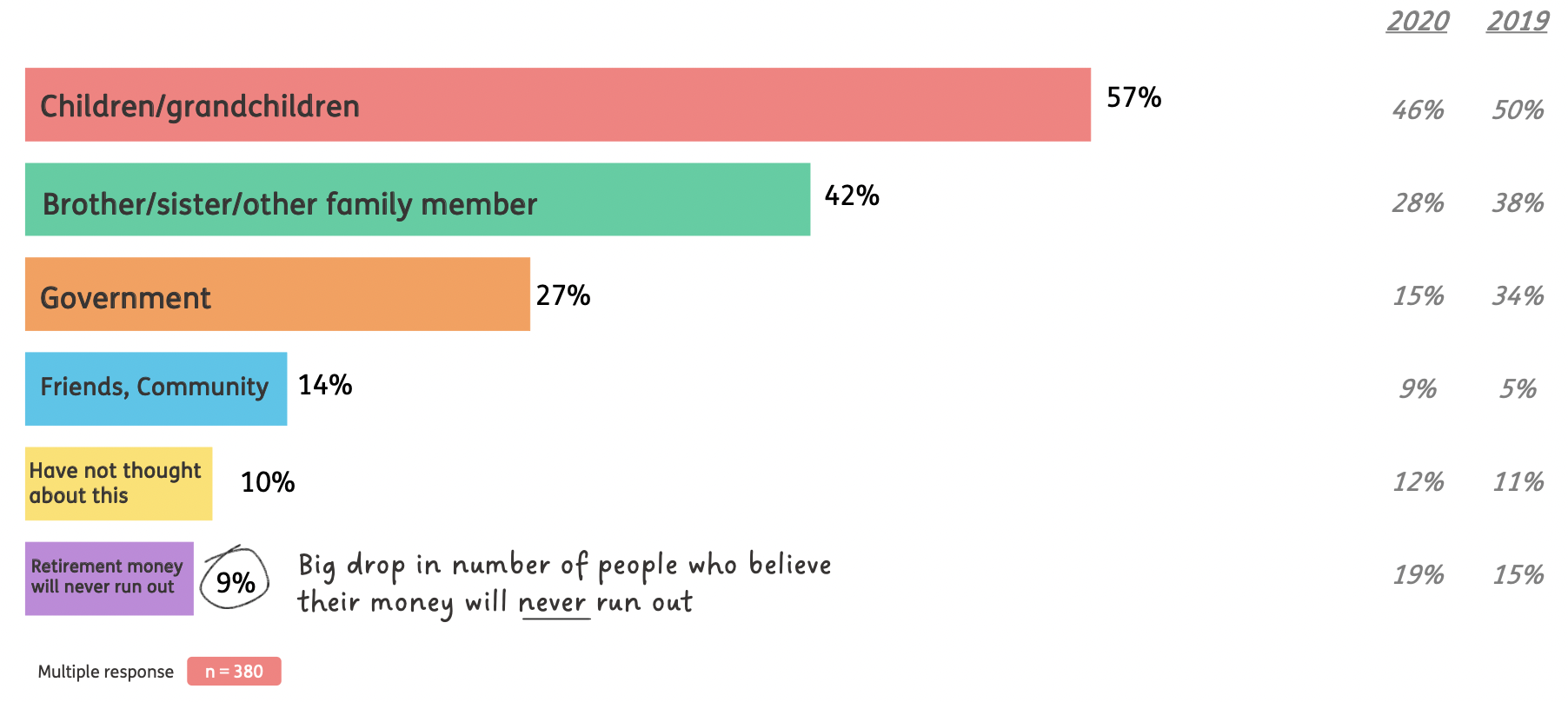

And will call on children for support

If your retirement money is enough for now, but may run out in the future, who will you rely on to provide support?

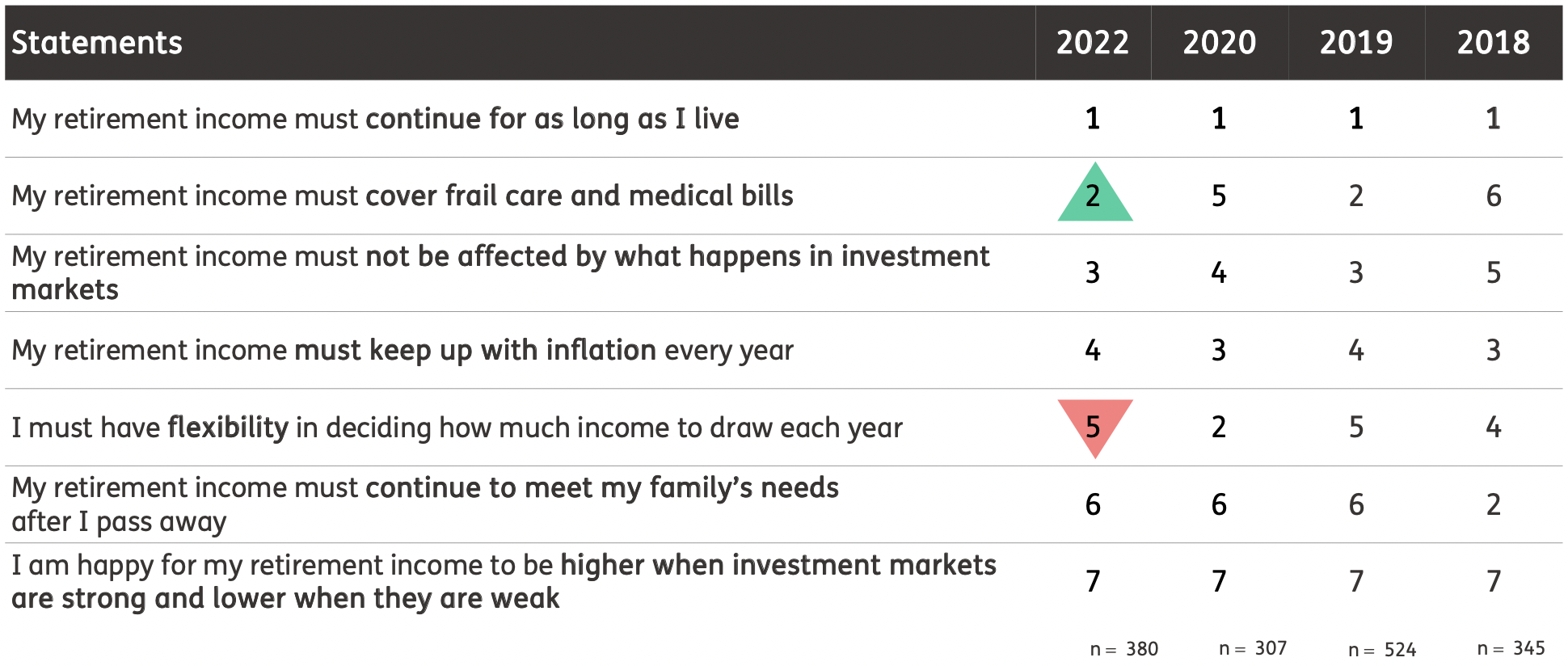

What income must do: certainty over flexibility

Income must last, it must not go up or down, it must keep pace with inflation

I am going to read you various preferences with regards to your retirement income. Please tell me how important each of these are to you? All statements were deemed important when it comes to retirement income, and are shown here from most to least important.

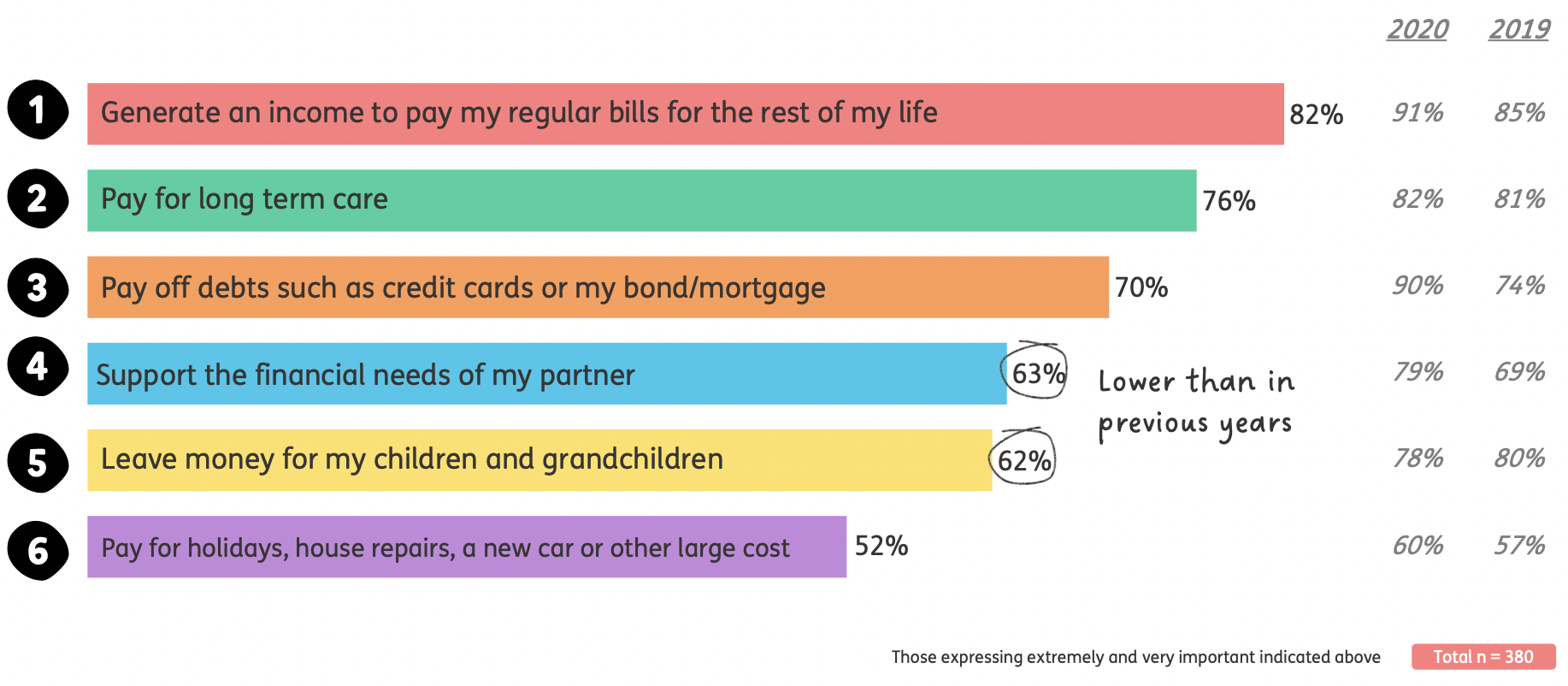

Priorities for retirement savings

Please rate the importance of each of the following in terms of how you will use the money you will get from your retirement savings when you retire?

(1 – Not important; 2 – Slightly important; 3 – Moderately important, 4 – Very important; 5 – Extremely Important)