Section 4

Secure a sustainable income

Saving for retirement will help save your retirement. Either keep something in reserve or have a guarantee to fall back on. Depending on the amount saved, income options at retirement offer different benefits and outcome.

Annuities provide a steady income during retirement

Applying the theory

Taking an astute couple from our survey into a practical example:

Age 65, and the other is two years younger

Current household income is R15 000 per month

R4,5m saved for retirement

Realistic in terms of income in retirement, knowing this is a modest amount

Still want to only draw R15 000 per month in retirement

Quietly confident that this annuity will cover monthly essential expenses (+/- R8 000) for life, which they think will only be for another 15 years

They do not want to seek advice from a financial adviser

Translates into a living annuity draw down rate of 4%

Applying the theory

And adding some other couples as further examples...

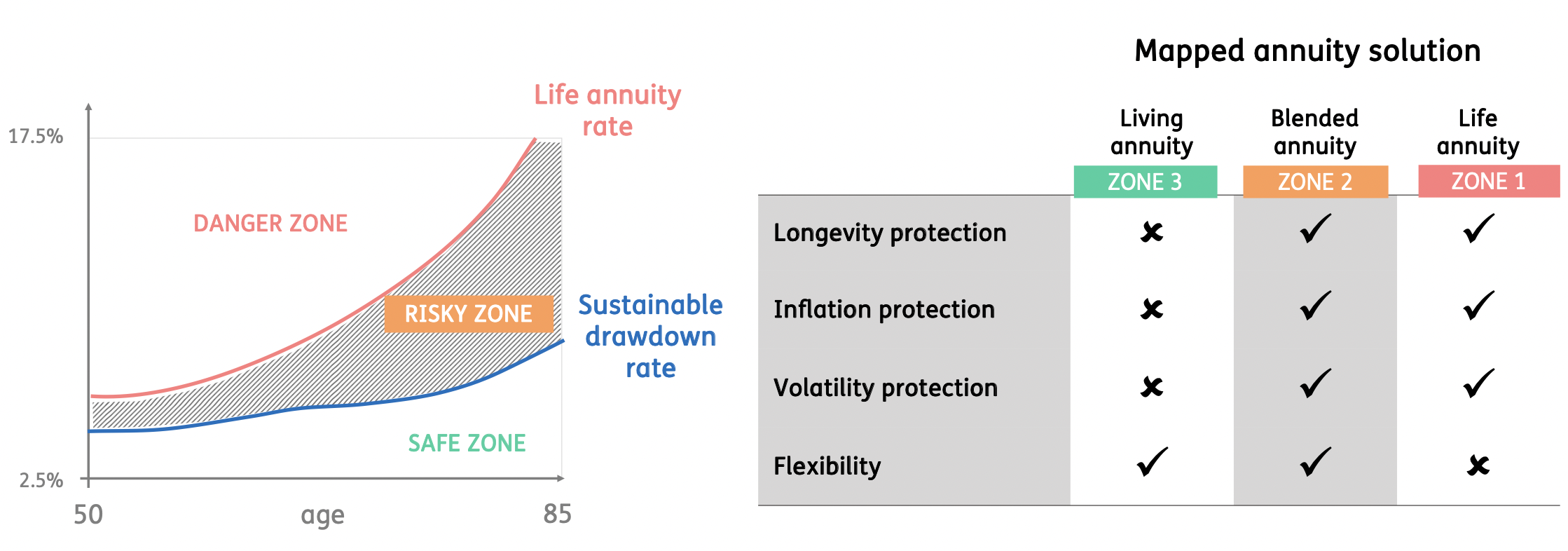

Drawdown rates in relation to age

Safe drawdown rates versus typical guaranteed life annuity rates

Based on life annuity rates which can be obtained from Just Lifetime Income (JuLI) StableGro

How your drawdown maps to an optimal retirement income solution

How your drawdown maps to an optimal retirement income solution

Do you need advice?

It is worth considering advice from a qualified financial adviser...

If you need help understanding your options – life, living and blended annuities

If you want to take account of your personal financial circumstances

If you are considering how your retirement savings can be used with other savings and investments to meet your financial needs

If you need to consider the tax implications of your choices

Contact Just or visit our website for more information, or for details of independent financial advisers in your area