Section 2

Retirement Confidence

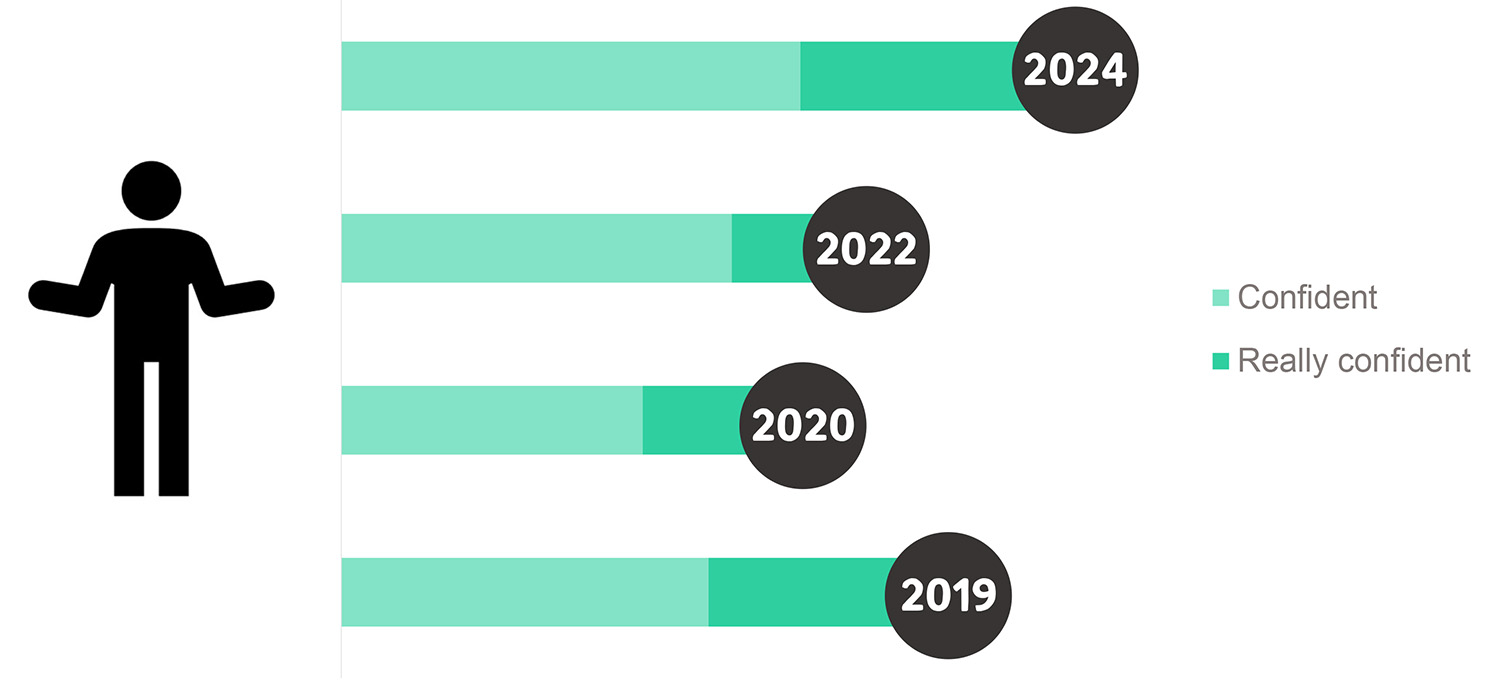

Feeling prepared and ready for retirement

Retirees seemingly regaining retirement confidence in a post-pandemic environment

But over-confidence can prevent people seeking help when they really need it.

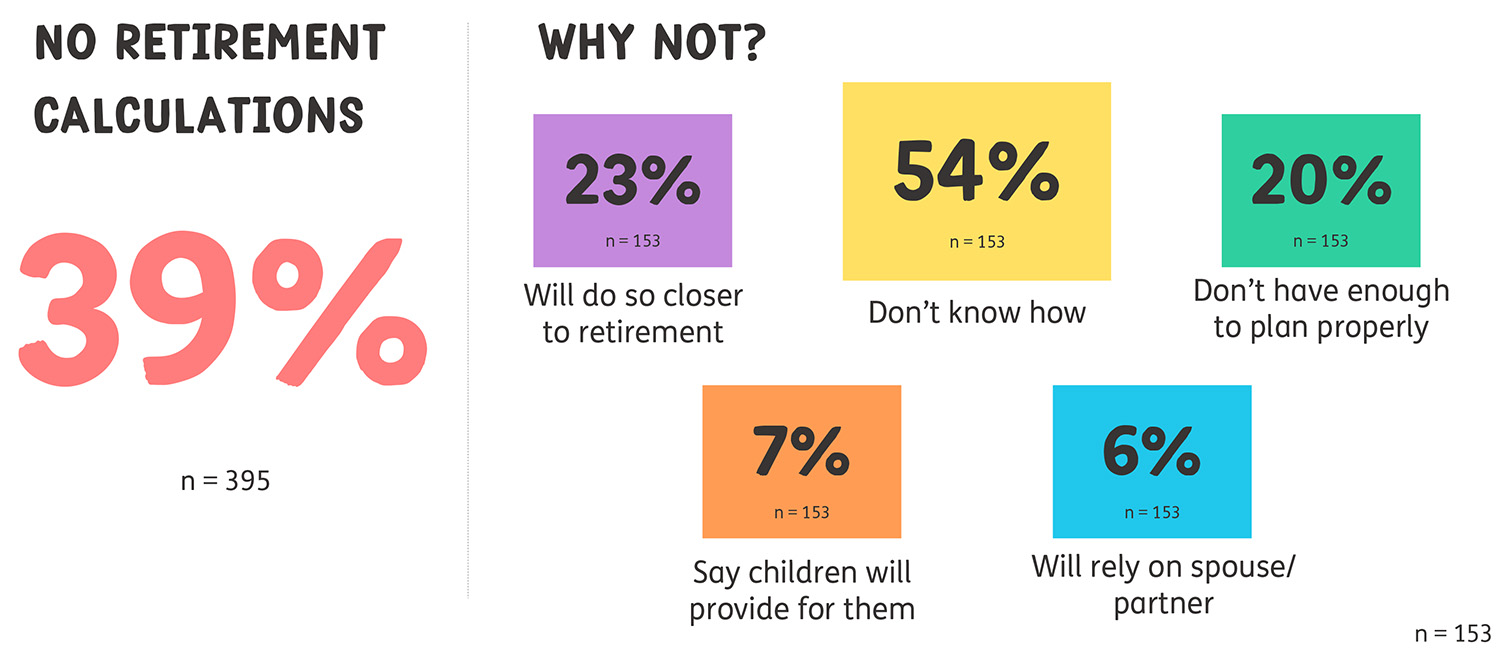

The study reveals that dependable lifetime income is a critical retirement planning goal. Yet almost 4 in 10 haven’t done any calculations for retirement, mainly because they don’t know how to.

Retirement confidence is not just for the financially savvy — it is a must no matter the size of your savings or the complexity of your financial situation.

View the detailed responses below.

Retirement Confidence: have YOU saved enough?

Confidence levels in 2024 were higher than in previous years, which could indicate that people have recovered a bit from the COVID years, or have put plans in place to ensure a sustainable retirement.

Please rate your level of confidence that your income (money) will cover your monthly expenses in retirement if you reach the age of 100, allowing for inflation.

Mean Score: Really confident = 5, Confident = 4, Not sure = 3, Not confident = 2 & Really not confident = 1

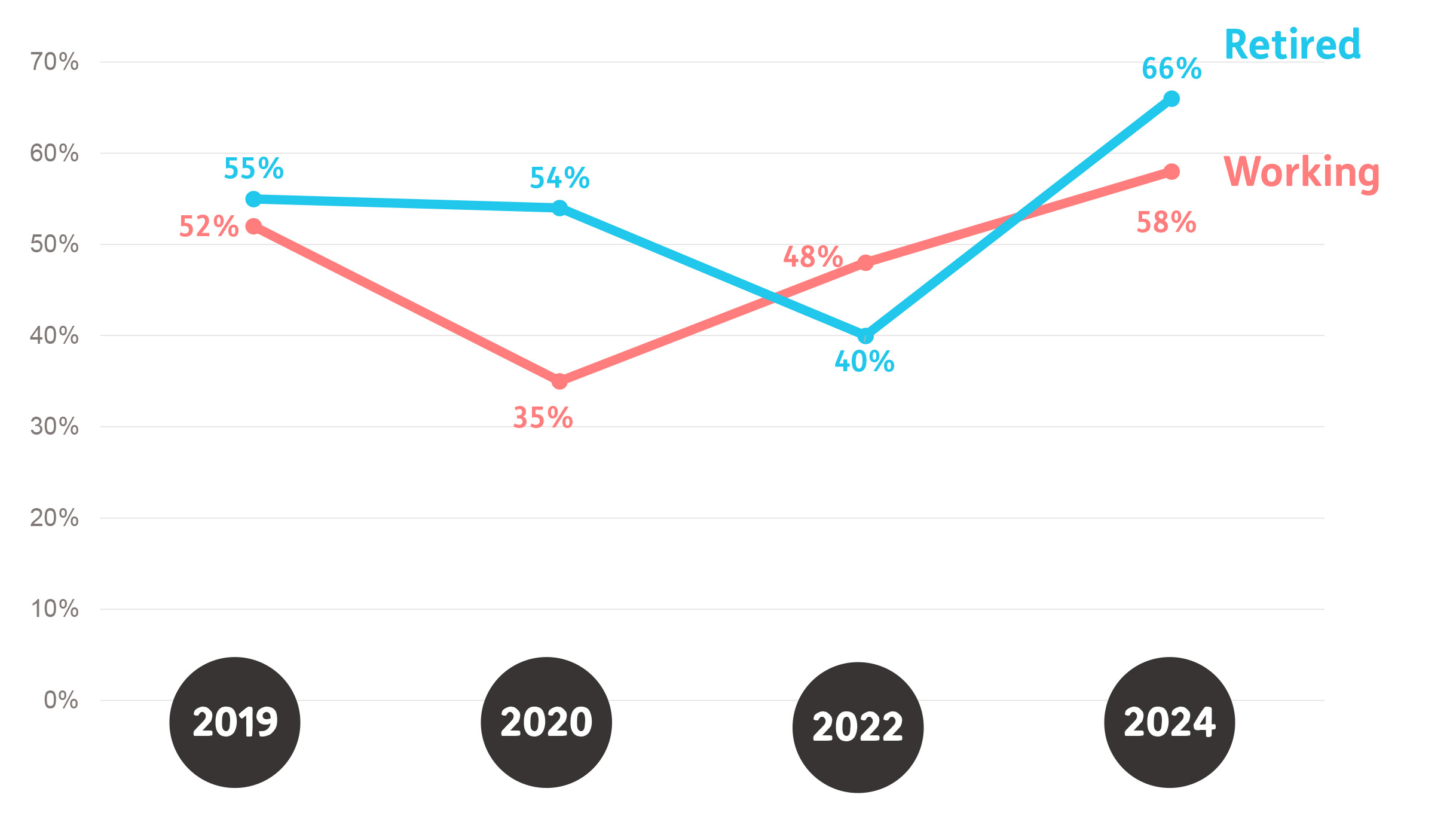

Retirement Confidence: have YOU saved enough?

Confidence of those who have already retired is slightly higher than those who are still working, which may explain why they are still working.

Please rate your level of confidence that your income (money) will cover your monthly expenses in retirement if you reach the age of 100, allowing for inflation.

Showing those who are Really confident and Confident

Over a third have NO financial retirement plans

There was a significant jump from 28% in 2022 to 54% of people who admit they don’t know how to plan for retirement.

Thinking of your retirement, have you made any calculations in terms of how much money you would need per year? (n=395); What are the main reasons for not yet doing any planning for your money in retirement?

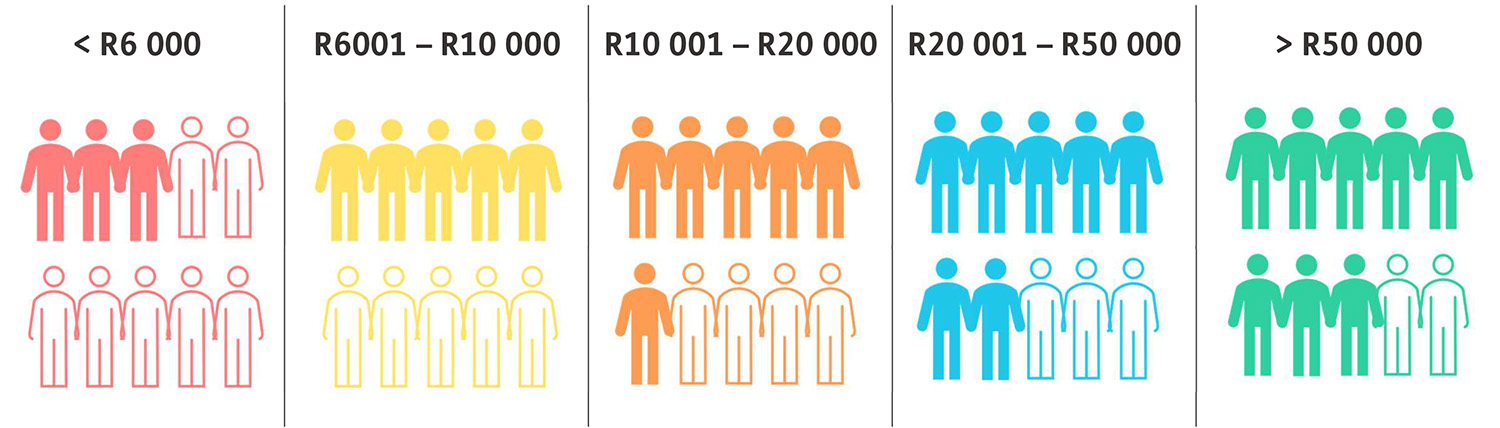

Lower income households less inclined to plan for retirement

Less propensity to plan for respondents in lower monthly household income brackets.

Have you made any calculations in terms of how much you would need per year?

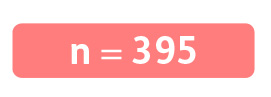

Intended use of Retirement Savings

Most intend to be smart with their retirement fund money, with a key objective to generate an income for life. But they also want to be able to cover long-term care and possible medical costs. A high percentage claim they will need it to pay off outstanding debts, which is concerning.

Please rate the importance of each of the following in terms of how you will use the money you will get from your retirement savings when you retire?

(1 – Not important; 2 – Slightly important; 3 – Moderately important, 4 – Very important; 5 – Extremely Important)

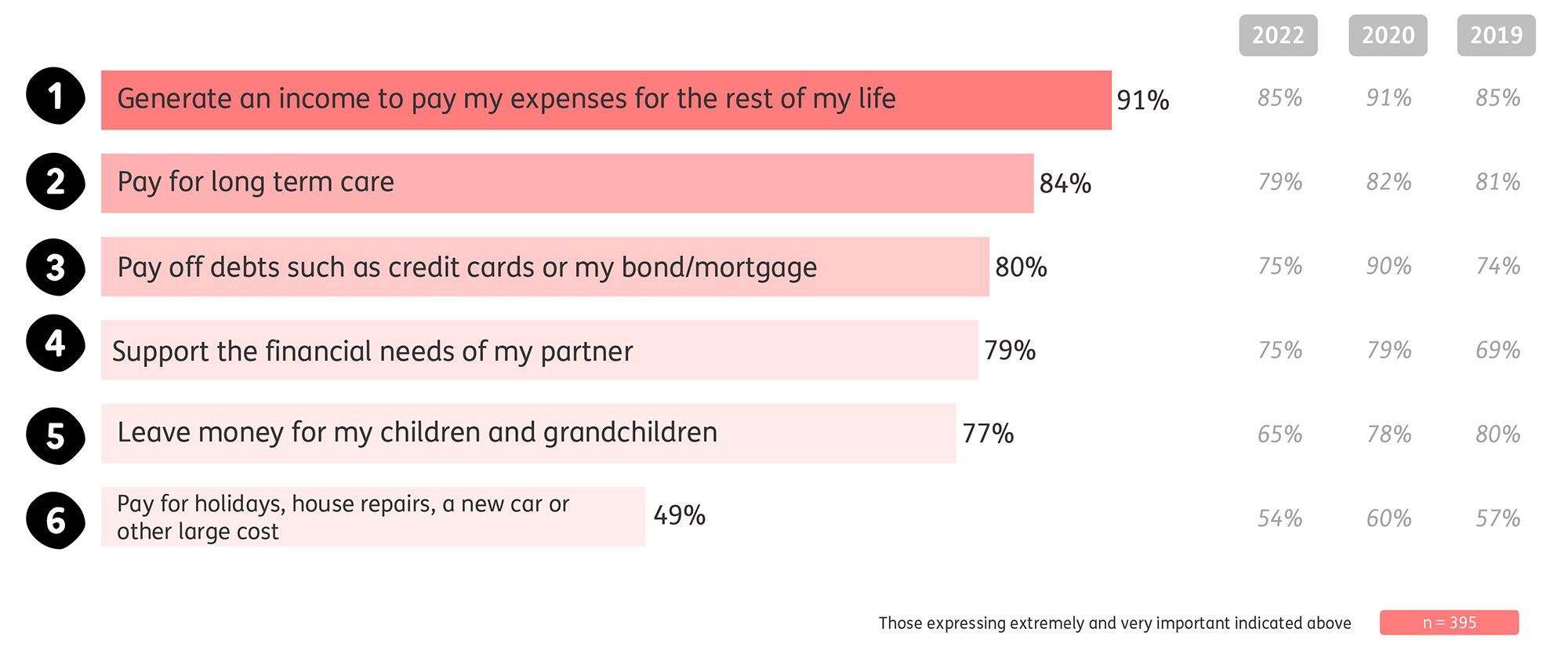

SELF preservation: CERTAINTY OVER FLEXIBILITY

Key needs remain largely unchanged flexibility is perceived to be less important compared to income must last, it must not go up or down, it must keep pace with inflation.

I am going to read you various preferences with regards to your retirement income. Please tell me how important each of these are to you?

All statements were deemed important when it comes to retirement income, and are shown here from most to least important.