Section 1

Self Confidence

Attitude about your skills and abilities

Unjustified self-confidence

The study reveals an unwarranted sense of certainty that could lead to poor decision-making or overestimation of financial resources.

Just over 50% plan ahead for retirement, but only 3 in 10 seek professional advice.

View the detailed responses below.

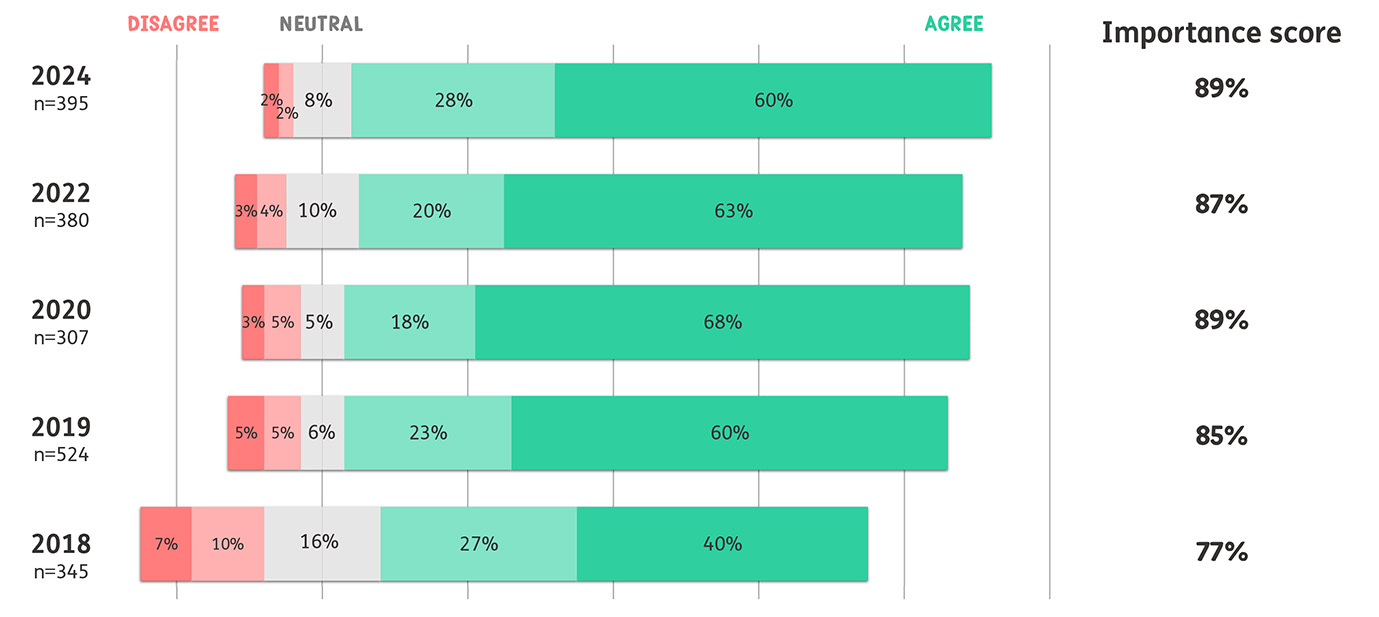

Importance of setting retirement objectives

Results show a significant increase over the last five years in respondents saying it is important to set retirement goals. In 2018 only 40% of respondents said they set goals for retirement, while this year the figure was 60%.

Please tell me to what extent you agree or disagree with the following statement about financial planning: I plan my finances. I set goals that I want to achieve and work towards that.

Mean Score: Strongly agree = 5, Somewhat agree = 4, Neither agree nor disagree = 3, Somewhat disagree = 2, Strongly disagree = 1

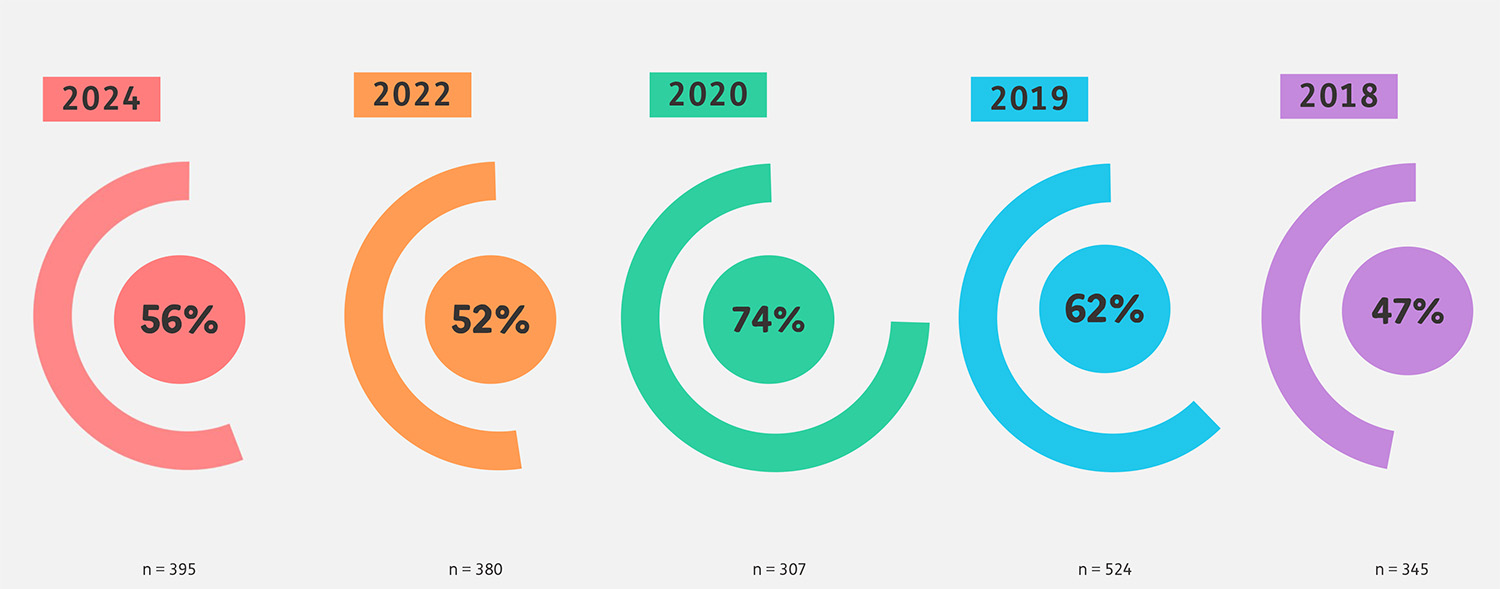

Majority claim to save & plan

Setting goals is a fundamental tool in retirement planning as it helps you understand what income you’ll need in retirement and whether or not your current financial actions support this.

Those who disagreed with statement: I do not save much or plan for the future; I prefer to spend money when I have it.

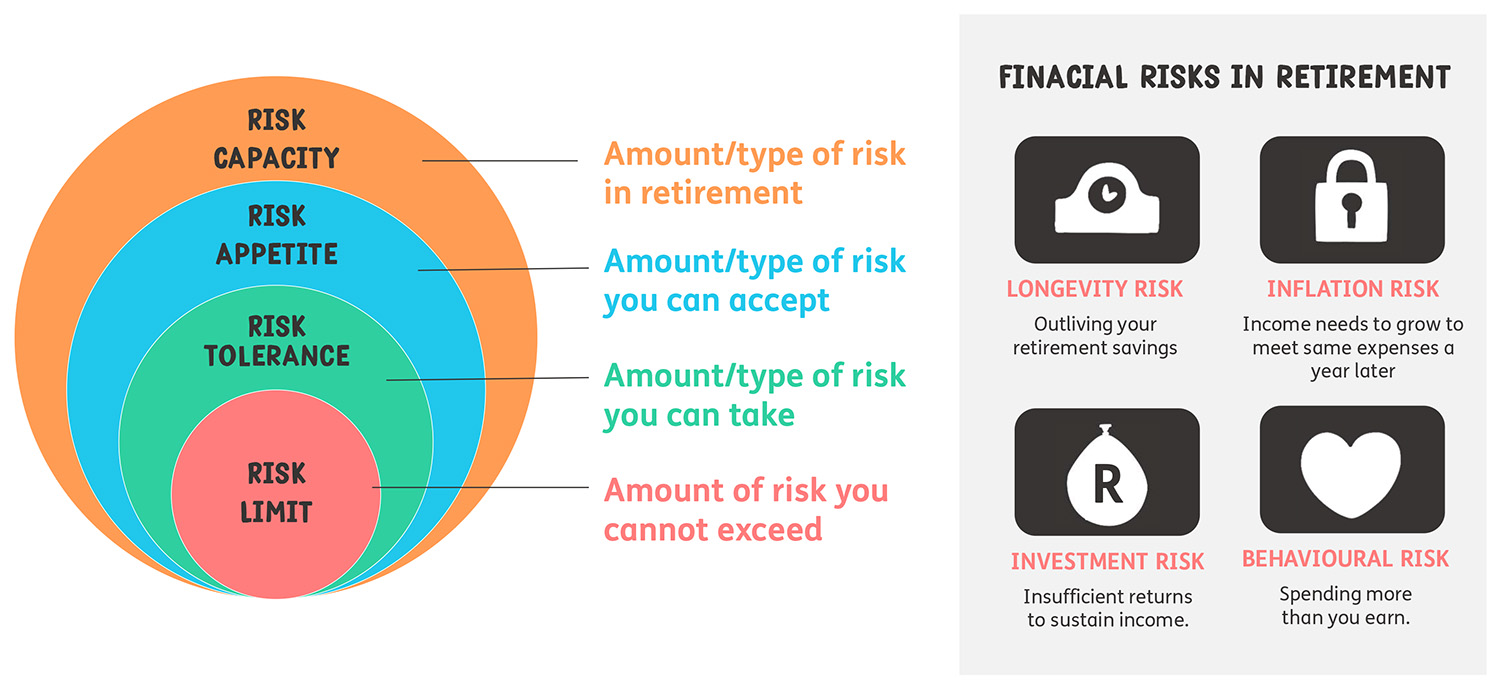

Retirement risk universe

This framework provides a litmus test against which retirees should evaluate their risks, as well the top financial risks in retirement.

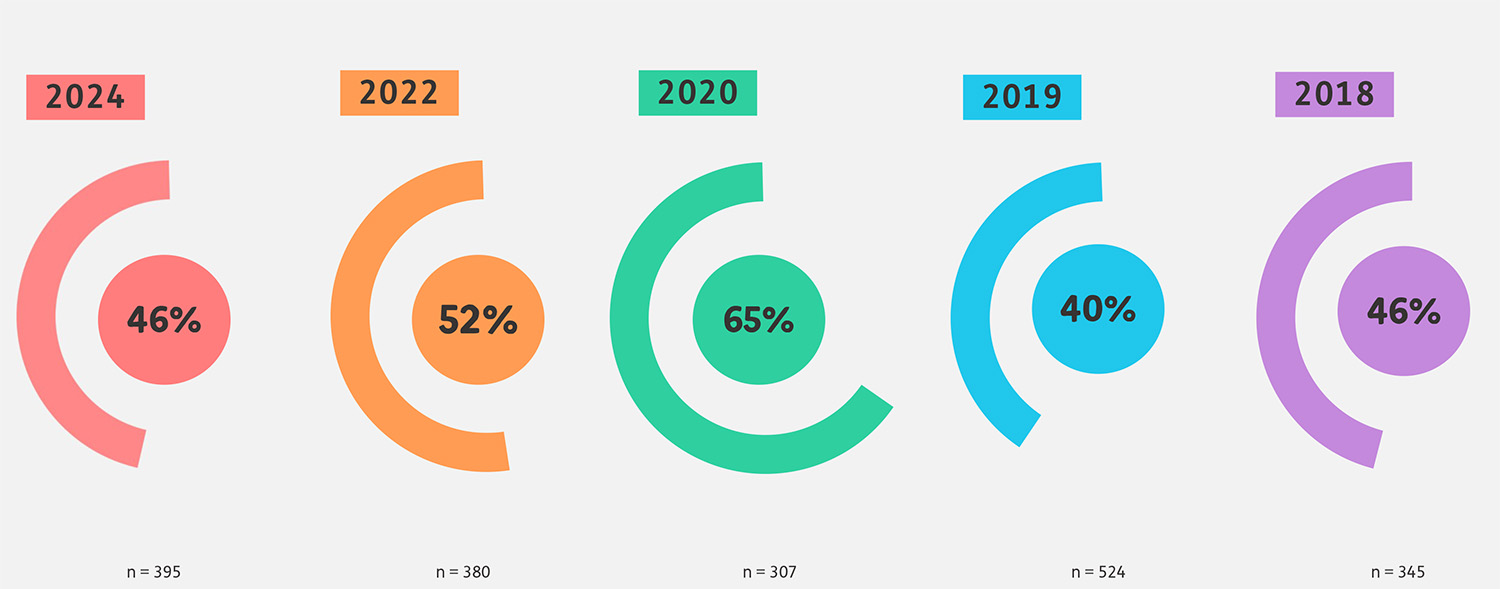

Retirees maintain a low-risk appetite

Less than half don’t want to take any risks in retirement

Those who disagreed with statement: I do not mind taking risks with my money for saving or investment purposes

Very few will tolerate financial losses

If you have control over how your retirement fund money is invested, what percentage do you think you could afford to lose in a market crash before it seriously impacts on your retirement plans?

Average value of retirement savings

Average savings of respondents has gradually increased over the years, but how much is enough?

What is the approximate current Rand value of all of your retirement savings?